-

Call Today404-902-5738

Request a Pro Forma

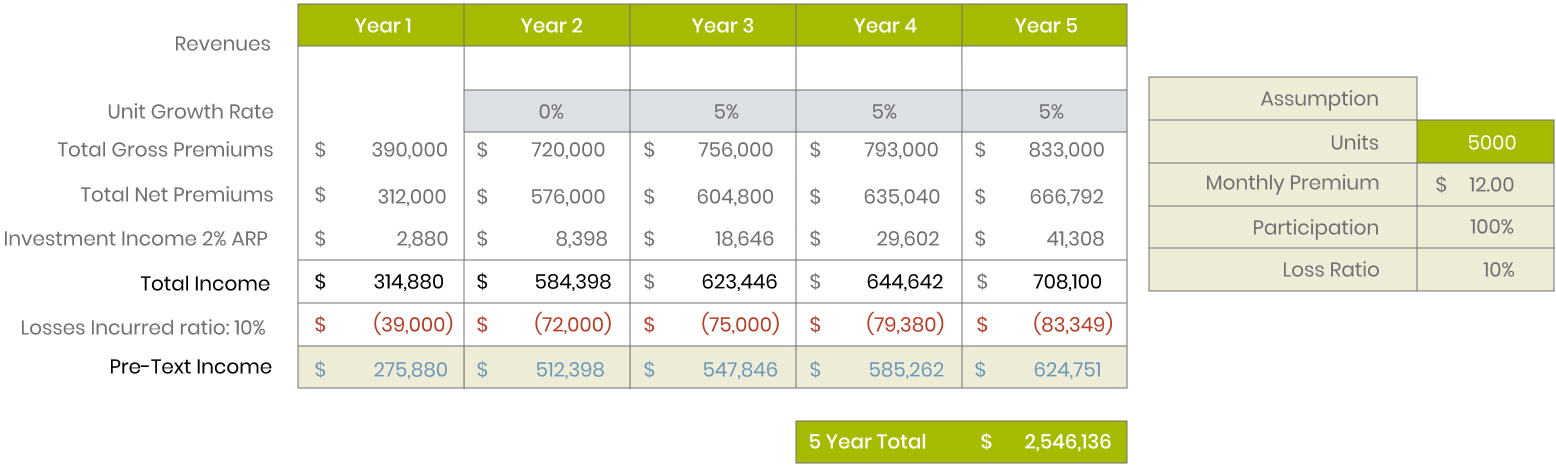

Please answer the following questions so that we can email you a customized Pro Forma detailing your potential profits.

See example below.

“This is truly found money and is the best of both worlds. It provides a great product from an operational standpoint because you have 100% coverage. Of all the business units we run, it has one of the highest ROIs. We spend very little time on it once it is set up. River Oak Risk does all of the heavy lifting.”

Sample Pro Forma for

Annual Profits

Five Year Profits

River Oak Risk

We are the leading captive management company for the multifamily market to self-insure for tenant liability which generates new revenue and decreases traditional costs – therefore improving your portfolio value.

Value

We are not insurance brokers and we do not sell renters insurance – we simply help you capture those economics that you are producing for others

Program Benefits

We are the leading captive management company for the multifamily market to self-insure for tenant liability which generates new revenue and decreases traditional costs – therefore improving your portfolio value.

Financial Gain

Net income on average of $100 per unit per year.

Eliminate Gaps

Program covers 100% of occupied units.

Increased Efficiency

Program is consolidated with lease for easy accounting and reporting.

Lower Costs

Valuable resources do not waste time collecting/verifying/managing certificates.

Personal Service

Dedicated customer service agents for each of our clients.

Additional Benefits

Your Captive allows you to self-insure in other areas of your business.

Request a Pro Forma Today

River Oak Risk is an experienced captive manager with expertise in helping clients evaluate if captive insurance is a valuable tool for their risk profile.